Moving Average

A Moving Average (MA) is a simple forecasting method that smooths out fluctuations in demand by averaging past sales over a specific period.

It helps identify trends and patterns without being influenced by short-term spikes or dips.

How It Works (Step-by-Step)

- Choose a Time Period: Decide how many past periods (e.g., days, weeks, or months) to include in the average.

- Calculate the Average: Add up sales for the chosen period and divide by the number of periods.

- Update as New Data Comes In: Drop the oldest data point and include the newest one to keep the average “moving.”

Types of Moving Averages

- Simple Moving Average (SMA) – A basic average of past values.

- Weighted Moving Average (WMA) – Assigns more weight to recent data (e.g., June’s sales might be weighted more than April’s).

- Exponential Moving Average (EMA) – Uses a formula to give exponentially higher weight to recent data, making it more responsive to trends.

1️⃣Simple Moving Average (SMA)

How it works:

- Takes the average of past data points over a fixed period.

- Each data point has equal weight

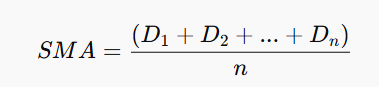

Formula:

Where D = demand (sales) and n = number of periods.

Example (3-Month SMA):

| Month | Sales (Units) |

|---|---|

| April | 100 |

| May | 120 |

| June | 110 |

SMA=(100+120+110)/3=110

Best for: Short-term forecasting when demand is stable.

Weakness: Can lag behind trends and doesn’t react to sudden changes.

2️⃣Weighted Moving Average (WMA)

How it works:

- Assigns more weight to recent periods.

- More responsive to changes than SMA.

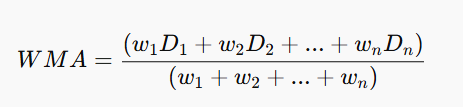

Where w = weight assigned to each period

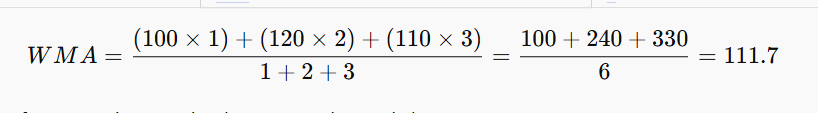

Example (3-Month WMA with weights 1, 2, and 3 for April, May, and June):

| Month | Sales (Units) | Weight |

|---|---|---|

| April | 100 | 1 |

| May | 120 | 2 |

| June | 110 | 3 |

Best for: Detecting trends when recent demand changes matter more.

Weakness: Choosing the right weights requires judgment.

3️⃣Exponential Moving Average (EMA)

How it works:

- Similar to WMA but assigns weights exponentially, so recent data has much more impact.

- Uses a smoothing factor (α) to control how much weight recent data gets.

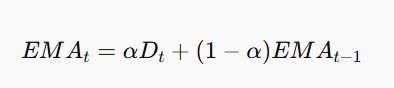

Where:

- EMAtEMA_tEMAt = current EMA

- DtD_tDt = current demand

- α\alphaα = smoothing constant (between 0 and 1)

- EMAt−1EMA_{t-1}EMAt−1 = previous EMA

Best for: Fast-changing demand patterns and real-time tracking.

Weakness: Needs an initial value and careful selection of α.

Which One Should You Use?

| Type | Use Case | Pros | Cons |

|---|---|---|---|

| SMA | Stable demand, no trends | Simple, easy to calculate | Lags behind trends |

| WMA | Recent data is more relevant | Responds better to trends | Requires choosing weights |

| EMA | Fast-changing demand, real-time | Reacts quickly to shifts | Needs fine-tuning (α) |

If demand is stable, SMA works fine. If trends matter, WMA is better. But if you need real-time, responsive forecasting, go for EMA.

Want to dive deeper into supply chain insights? Sign up for our newsletter and get clear, actionable articles delivered straight to your inbox—no spam, just valuable tips to boost your forecasting and supply chain strategies.